Ecommerce Market Research: 10 Steps to Get Started

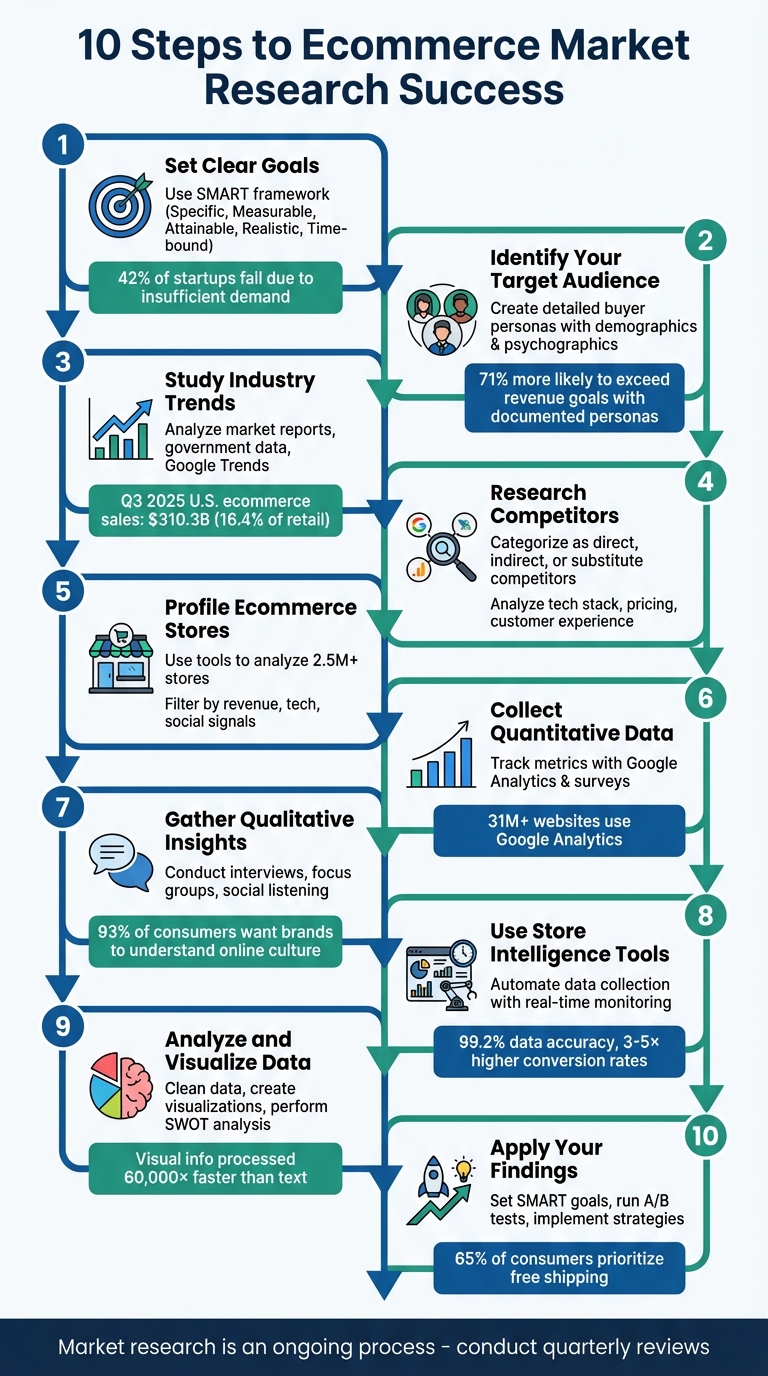

10-step ecommerce market research guide: set SMART goals, define buyer personas, analyze trends and competitors, collect data, and test strategies.

Ecommerce market research helps businesses understand customer behavior, analyze competitors, and identify growth opportunities. Without it, companies risk failure - 42% of startups fail due to insufficient demand. This guide outlines a 10-step process to build data-driven strategies and avoid costly mistakes:

- Set Clear Goals: Define specific, measurable objectives using the SMART framework.

- Identify Your Target Audience: Use data to create detailed buyer personas, focusing on demographics and psychographics.

- Study Industry Trends: Analyze market reports, government data, and tools like Google Trends to spot demand patterns.

- Research Competitors: Categorize competitors (direct, indirect, substitutes), analyze their strengths/weaknesses, and track their strategies.

- Profile Ecommerce Stores: Use tools like StoreCensus to analyze store performance, tech stacks, and social signals.

- Collect Quantitative Data: Leverage tools like Google Analytics and surveys to gather metrics like traffic, conversion rates, and customer demographics.

- Gather Qualitative Insights: Conduct interviews, focus groups, and social media analysis to understand customer motivations.

- Use Store Intelligence Tools: Automate data collection with platforms like StoreCensus for real-time insights and trend tracking.

- Analyze and Visualize Data: Clean, integrate, and visualize data with charts to uncover actionable insights.

- Apply Findings: Turn insights into SMART goals, refine messaging, and test strategies through A/B experiments.

Market research is an ongoing process that ensures businesses align with customer needs and stay competitive. By following these steps, you can base decisions on hard data, not assumptions, and improve your chances of success.

10-Step Ecommerce Market Research Process Guide

How To Do Market Research For Your Ecommerce Store

Step 1: Set Clear Research Goals

Jumping into ecommerce market research without clear goals is like setting sail without a map - you're bound to waste time and money. Well-defined, measurable goals act as your guide, ensuring that every piece of data you collect serves a meaningful business purpose instead of cluttering your spreadsheets with irrelevant information.

Skipping this step can be costly. Companies that rely on assumptions instead of data-driven decisions often face setbacks. Research consistently highlights the importance of grounding strategies in clear, actionable goals. This is why setting a strong foundation with precise objectives is so important.

To make your goals effective, use the SMART framework: Specific, Measurable, Attainable, Realistic, and Time-bound. For example, instead of aiming to "understand our customers better", try something more defined: "Identify the top three reasons for cart abandonment among first-time visitors within 30 days." This level of detail not only helps you allocate resources wisely but also makes it easier to measure success.

Tailoring your research goals to address specific ecommerce challenges is key. Whether you're launching a new product, entering a new market, or boosting repeat purchases, your research should focus on solving real business problems. Take iHeartRaves, for instance. When the COVID-19 pandemic shut down music festivals in 2020, the apparel brand set a clear goal: identify new market opportunities. Their focused research led to a successful pivot into selling face masks, allowing them to stay afloat during the crisis.

Clear goals also help you create detailed buyer personas, a common research objective. Companies that document these personas are 71% more likely to exceed their revenue and lead generation targets. Whether you're validating pricing strategies, finding underserved niches, or analyzing why a rebranding effort missed the mark, clearly defining your research objectives ensures your efforts lead to actionable results.

Step 2: Identify Your Target Audience

Once you've set your research goals, it's time to define your target audience. Without a clear focus on who you're trying to reach, your marketing efforts could end up being a waste of time and money. In fact, companies that document buyer personas see a 71% boost in revenue and lead generation. That’s why this step is so crucial for ecommerce success.

Start by diving into the data you already have. Look at your CRM system, purchase history, and Google Analytics to uncover patterns in customer behavior. Pay attention to key demographics like age, gender, location, income, and education. But don’t stop there - dig deeper into psychographics, such as values, interests, and lifestyle preferences. Understanding purchasing habits and even the devices your customers prefer can give you the insights needed to craft a more targeted approach.

The more specific you get, the better. Generic targeting just doesn’t cut it anymore. As Elizabeth Gardner explains:

It's hard to target a message to a generic 35-year-old middle-class working mother of two. It's simpler to target a message to 'Jennifer' - a paralegal with two young children seeking quick, healthy dinners.

By creating detailed personas like "Jennifer", your marketing becomes more personal and memorable, helping you stand out from the competition.

To gather these insights, use a variety of research methods. Post-purchase surveys through tools like SurveyMonkey or Typeform can reveal customer motivations and frustrations. Social media platforms such as Instagram, Reddit, and X (formerly Twitter) are treasure troves for discovering what your audience is talking about. Customer reviews - whether on Amazon, Trustpilot, or your own website - can highlight common complaints or desires. Even competitor reviews can uncover underserved niches you might be able to address.

The payoff for this level of personalization is huge. Tailored marketing campaigns can increase transactions and revenue by up to six times compared to generic ones. When you truly understand your audience - their pain points, their language, and their shopping habits - you can create experiences that far outperform the average 2% ecommerce conversion rate.

Step 3: Study Industry Trends

Once you’ve nailed down your audience, the next step is to dive into industry trends and gauge real market demand. For example, in Q3 2025, U.S. retail ecommerce sales hit an estimated $310.3 billion, making up 16.4% of total retail sales. This figure sheds light on whether the market is growing or shrinking.

Start by exploring government data sources. The U.S. Census Bureau releases quarterly ecommerce reports with detailed sales figures and market share data. If you’re looking for stats specific to your niche, use your North American Industry Classification System (NAICS) code to refine your search in these databases. You can also check out resources like the Bureau of Labor Statistics and the Bureau of Economic Analysis for insights into employment trends and consumer spending habits.

For a broader perspective, commercial platforms like Statista, Allied Market Research, and Grand View Research provide reports on market size and Compound Annual Growth Rate (CAGR), which are great for evaluating long-term growth potential. Industry-specific publications like HubSpot's "State of Marketing Report" or Salesforce's Shopping Index can help you measure your store’s performance against industry benchmarks.

Don’t overlook tools like Google Trends to spot long-term opportunities. By setting the timeframe to "Past 5 Years", you can identify products with consistent growth rather than those experiencing short-lived popularity. This simple step can help you avoid chasing trends that fizzle out quickly. After all, 42% of startups fail because there’s not enough market demand. Thorough research into these patterns ensures your efforts lead to actionable insights and smarter decisions.

Step 4: Research Your Competitors

Getting a clear picture of your competitors is key to spotting opportunities in the market. Start by dividing them into three categories: direct competitors (those selling the same products to the same audience), indirect competitors (offering different products that address the same problem), and substitute competitors (providing alternative solutions to meet the same customer need). For instance, if you run a coffee subscription service, other coffee subscriptions are direct competitors, while energy drink brands and smoothie bars fall under indirect or substitute competitors. Once you’ve identified them, take a closer look at how they operate to uncover their strengths and weaknesses.

Pay attention to their technology and operational setup. The ecommerce platform they use, whether it’s Shopify, Magento, or something else, impacts their site speed, mobile experience, and checkout process. There are tools available that can help you analyze these details. Also, consider metrics like revenue estimates, traffic sources, and average order values to find areas where you can outperform them.

Numbers are important, but don’t stop there - experience their sales process firsthand. Sign up for their email newsletters, follow them on social media, and even make a purchase to get a feel for their customer journey. This can help you identify any gaps or inefficiencies in their service. Additionally, review platforms like Google or the Better Business Bureau can reveal recurring customer complaints and service gaps.

To take your analysis further, use a Growth Quadrant framework to map competitors based on their growth rate and audience size. This gives you four groups: Leaders (fast growth, large audience), Game Changers (new players with high growth potential), Established Players (large but slower growth), and Niche Players (small with low growth). This approach helps you determine where to focus your attention. Study Leaders for their marketing strategies and user experience, track Game Changers for emerging trends, and look for service gaps in Established Players that you can address more effectively.

Keep detailed notes on pricing, unique features, social media activity, and customer sentiment. Rate competitors on aspects like product quality, customer service, and website performance using a 1-to-10 scale. This kind of scoring system makes it easier to see where you excel and where you need to step up. As content strategist Lizzie Davey advises:

Monitor top competitors closely to identify emerging opportunities.

Step 5: Profile Ecommerce Stores

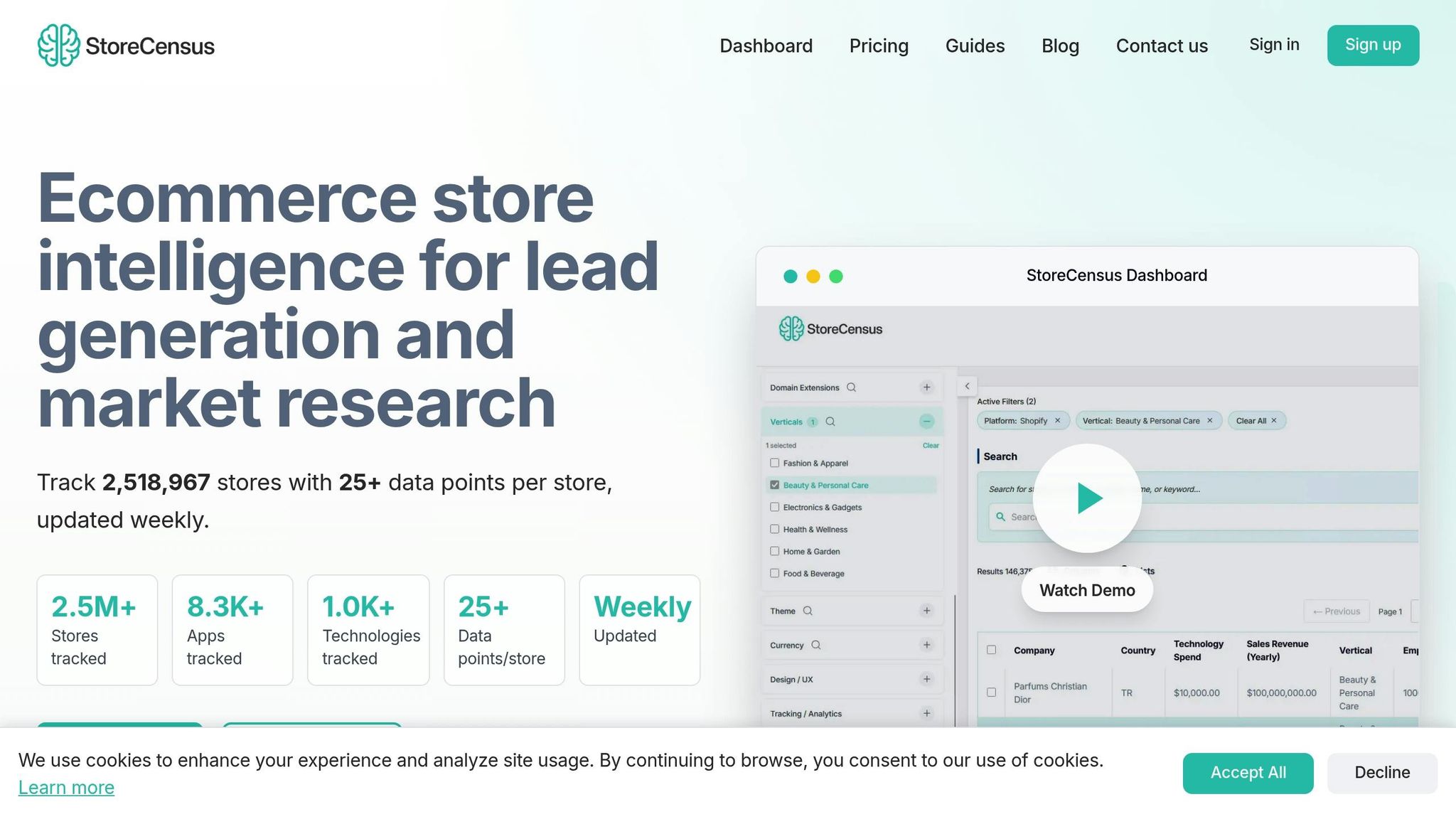

After mapping out your competitive landscape, it's time to dive deeper into analyzing ecommerce stores. With access to a database of over 2.5 million active ecommerce stores, you can use advanced filters to zero in on specific products, locations, and performance metrics. For instance, you can refine your search by location and estimated monthly sales to group merchants by revenue. If you're targeting U.S.-based Shopify apparel stores that sell at least 10 products, you can create a precise query to find exactly what you need.

The platform also lets you filter by technology stack, identifying stores based on their ecommerce platform and the apps they use. Social signals add another layer, allowing you to find stores active on platforms like TikTok, Instagram, or LinkedIn. Real-time updates ensure you stay ahead of trends before they go mainstream. By combining factors like revenue, monthly app spending, and employee count, you can prioritize high-value prospects or benchmark stores at a similar growth stage. Plus, the free Chrome extension makes it easy to gather profiling data while browsing individual ecommerce sites. All these tools integrate smoothly with StoreCensus's pricing plans, which cater to various research needs.

StoreCensus Pricing Plans

StoreCensus offers flexible pricing plans to suit different research needs and team sizes:

- Free Plan: Includes 50 actions, 3 credits, basic filters, and CSV exports - perfect for testing the platform.

- Starter Plan: Priced at $39/month, it offers 4,000 credits, 2 automation flows, and basic filters for small-scale research.

- Professional Plan: At $79/month, this plan is ideal for regular market research. It includes 15,000 credits, 10 automation flows, advanced filters, a built-in CRM, decision-maker contacts, and API access.

- Growth Plan: For $149/month, this plan scales to 35,000 credits, 25 automation flows, team access, and lookalike audience features.

- Enterprise Plan: Designed for large organizations, it costs $599/month and includes unlimited credits, 50 automation flows, and priority support.

Each plan is designed to help you tailor your research and scale as your needs grow. Whether you're just starting out or managing a large team, there’s an option to fit your goals.

Step 6: Collect Quantitative Data

Numbers tell the story behind your business decisions. Metrics like website traffic, conversion rates, sales figures, and customer demographics provide the solid foundation you need to replace guesswork with evidence.

Take Google Analytics, for example. It’s a tool trusted by over 31 million websites. The free GA4 version uses event-based tracking to monitor specific user actions - like product views, add-to-cart clicks, and completed purchases. With it, you can identify which traffic sources drive the most customers, pinpoint where visitors drop off during checkout, and even track revenue by product category. Here’s a real-world example: In 2025, a small jewelry business noticed through Google Analytics that mobile users on certain devices were abandoning their carts. After fixing a glitch in their mobile interface for those screen sizes, they saw a 20% increase in mobile conversions within just two months. This kind of internal data not only highlights areas for improvement but also sets the stage for comparing your performance to the broader market.

For a bigger picture, tools like StoreCensus provide market-level insights. These include estimated monthly sales, revenue benchmarks, and technology adoption rates, helping you see how your business stacks up against the competition.

Surveys are another powerful way to gather numbers directly from customers. Platforms like SurveyMonkey and Typeform (starting at $25/month) make it easy to collect demographics and satisfaction scores. Use metrics like the Net Promoter Score (NPS), which measures long-term loyalty on a 0-10 scale, or the Customer Satisfaction Score (CSAT), rated on a 1-5 scale, to evaluate customer experiences. To maximize engagement, keep surveys short and send them right after a purchase when the experience is still fresh. Sweeten the deal by offering incentives like discounts or free shipping to encourage participation.

"Market research gives you the insight you need to make business decisions on data rather than guesses. Which means there may be less risk involved when making decisions." - Dana Nicole, Semrush

Finally, tracking key metrics like average order value (AOV), customer lifetime value (CLV), conversion rates, and bounce rates can help you fine-tune pricing strategies and website design. With global ecommerce sales expected to hit $6.33 trillion in 2024 and nearly $8 trillion by 2027, understanding these numbers isn’t just helpful - it’s essential for capturing your share of the market.

Step 7: Gather Qualitative Insights

Once you've collected quantitative data, it's time to dig deeper into customer motivations through qualitative research. While numbers can tell you what's happening, qualitative insights help you understand why it's happening. For instance, if your quantitative data shows a high bounce rate on your checkout page, qualitative research might reveal if customers are confused by the layout, worried about security, or frustrated by limited payment options. Combining these two types of data gives you a more complete picture of your market.

One-on-one interviews are a great way to uncover emotions and experiences that surveys might miss. These conversations are particularly useful for sensitive topics or complex buying decisions. To get the most out of interviews, stick to open-ended questions - think "how" or "why" instead of yes-or-no formats. This encourages participants to share detailed responses. Record the sessions to capture exact phrasing, and don't overlook the valuable insights your sales team can offer from their daily customer interactions.

Focus groups, typically made up of 6–10 participants, create dynamic discussions where different perspectives can surface. They're especially effective for testing new product ideas or marketing messages, as participants often feed off each other's thoughts. Online focus groups have gained traction because they remove geographic limitations, making it easier to gather diverse opinions. To ensure success, over-recruit by about 20% to account for no-shows, keep sessions under two hours to avoid fatigue, and use a neutral moderator to maintain objectivity. While interviews and focus groups provide direct feedback, social media analysis offers an unfiltered look at customer sentiment in real time.

"The critical missing piece is having a clear understanding of the why - or why not - behind what shoppers do. This knowledge gap can lead to developing sub-optimal solutions and missed opportunity." - Explorer Research

Social media analysis is a powerful way to gauge how customers truly feel about your brand. By monitoring brand mentions, hashtags, and community discussions, you can stay on top of real-time sentiment. Tools like Sprout Social make it easier to track these conversations across platforms. Dive into niche communities on Reddit, Slack, or Facebook groups, where people often share honest opinions about their frustrations and preferences. Pay close attention to the language and slang they use - this "voice of customer" data can make your marketing copy feel more natural and relatable. With 93% of consumers believing it's important for brands to stay in tune with online culture, keeping an ear to these conversations is a must.

Step 8: Use Store Intelligence Tools

Once you've gathered qualitative insights, the next move is to tap into tools that transform raw data into actionable strategies. These store intelligence platforms streamline data collection and analysis, allowing you to focus on making informed decisions rather than wrestling with manual tracking. By automating tasks, these tools take the guesswork out of market research and help you act with precision.

Take StoreCensus, for example. This platform monitors over 2.5 million ecommerce stores, offering more than 25 data points per store. These include details like tech stack, revenue estimates, traffic metrics, and product catalog size. With daily crawls and multi-source verification, StoreCensus achieves an impressive 99.2% data accuracy. Real-time updates keep you informed about shifts in the market - whether it’s a competitor adjusting their pricing or removing a key app. Plus, historical data reveals patterns that help you differentiate between fleeting trends and sustainable growth. This combination of real-time tracking and historical analysis equips you to make quick, confident decisions.

The platform also integrates smoothly with your existing tools. It supports API and CSV exports to keep your CRM and business intelligence systems up-to-date. With compatibility for over 5,000 apps via Zapier - including HubSpot, Salesforce, and Slack - it ensures your workflows remain uninterrupted.

StoreCensus goes a step further with advanced filters and automation workflows. These features help you pinpoint market gaps and set up alerts for critical changes. For instance, automation workflows can notify you instantly about key market shifts, leading to conversion rates that are 3–5× higher than standard outreach methods. The advanced filters also let you segment the market by factors like business scale and performance metrics, so you can focus on the most relevant opportunities.

If you're curious to try it out, StoreCensus offers a free trial with 3 credits to test its filters and data quality. When you're ready to commit, the Starter plan starts at $39 per month, providing 4,000 credits and 2 automation flows. For those needing more, the Professional plan at $79 per month includes 15,000 credits, 10 automation flows, and API access - making it a great choice for most researchers.

With its mix of real-time monitoring, historical insights, and automated workflows, store intelligence tools like StoreCensus ensure you're always ahead of the curve and ready to adapt to market changes.

Next, learn how to analyze and visualize your data for faster, clearer insights.

Step 9: Analyze and Visualize Your Data

Turn raw numbers into meaningful insights by cleaning and integrating your data sources. Start by tidying up your data - remove outliers, correct inconsistencies, and double-check its accuracy. Once your data is reliable, combine quantitative metrics with qualitative feedback to uncover not just patterns, but the reasons behind them. As Alan Dix, a Professor of Human-Computer Interaction, puts it:

"Quantitative methods tend to tell me whether something happens and how common it is... Qualitative methods... give me the 'why' answers if I'm trying to understand why it is I'm seeing a phenomenon".

After cleaning and merging your data, the next step is to make it understandable through visualization.

Data visualization translates complex analysis into clear, actionable insights. Since visual information is processed up to 60,000 times faster than text, graphs and charts can help you quickly identify trends and relationships. For example:

- Use bar charts to compare revenue across sales channels.

- Line graphs work well for spotting seasonal trends over time.

- Scatter plots can highlight correlations, like how ad spend influences conversion rates.

- For tracking customer journeys, Sankey diagrams show where users drop off between landing pages and checkout.

Keep your visuals simple and focused to avoid overwhelming your audience.

| Analysis Type | Purpose | Use Case |

|---|---|---|

| Descriptive | Summarizes past data to show what happened | "What were our sales figures last quarter?" |

| Diagnostic | Explains causes of trends | "Why did cart abandonment increase by 15%?" |

| Predictive | Forecasts future outcomes | "What will demand look like during the holidays?" |

| Prescriptive | Recommends specific actions | "Which pricing strategy will maximize ROI?" |

Go deeper by refining your buyer personas. Combine demographic details with psychographics to better understand your customers' values and communication styles. For instance, analyzing customer reviews might reveal that people describe shipping delays as "frustrating" rather than "inconvenient", offering valuable clues for more effective messaging. Segment your audience based on shared traits to uncover high-growth opportunities or underserved markets. A SWOT analysis can also help you align your strengths, weaknesses, opportunities, and threats with what the data reveals about your competitive position.

Businesses that use analytics effectively to improve marketing and sales are 1.5 times more likely to achieve above-average growth rates and often see a 5% higher return on sales. But don’t stop at visualizations - translate your insights into actionable strategies. For example, if hidden costs are causing cart abandonment, test transparent pricing to improve conversions. Keep in mind, 42% of startups fail because there’s no real market need for their product. Let data guide your decisions on product development, messaging, and pricing to ensure you’re solving actual customer problems, not chasing assumptions. These insights will directly influence the strategic moves covered in Step 10.

Step 10: Apply Your Findings

Insights only make a difference when you put them into action. Start by turning your research into clear, SMART goals. For example, you might aim to identify three features millennial parents value most by the end of Q3. These goals ensure your findings translate into real-world strategies.

Next, refine your messaging using the exact language your customers use. If your research shows customers describe a competitor's shipping as "painfully slow" instead of just "delayed", emphasize your fast delivery as a clear advantage. Research shows that companies with detailed buyer personas based on such insights are 71% more likely to exceed revenue and lead goals.

StoreCensus makes targeted outreach easier with automation. Once you've pinpointed high-potential store segments - like Shopify stores using specific payment processors in niche markets - set up automated systems to keep tabs on new stores meeting these criteria. These systems can trigger personalized outreach efforts. With API access available on Professional plans and higher, you can integrate store intelligence directly into your CRM, ensuring your sales team always has up-to-date insights on prospects' tech stacks, estimated revenue, and social presence.

Test your findings with A/B experiments to confirm their impact. For instance, if your research shows free shipping boosts conversions - and 65% of consumers consider free shipping their top priority when making a purchase - try experimenting with different messaging or free shipping thresholds to see what resonates best. Avoid relying solely on instinct when making decisions.

Finally, embed your research into your ongoing operations. Market research isn’t a one-and-done task - it’s a continuous cycle. Consumer preferences shift, and new competitors or technologies can disrupt the ecommerce landscape. Schedule quarterly reviews to stay ahead. Use StoreCensus’s real-time updates and historical data to monitor how the market evolves. Regular check-ins ensure your strategies adapt to changing conditions.

Conclusion

This guide's 10-step framework shifts decision-making from guesswork to actionable, data-backed strategies. By understanding your customers, their desires, and how your competitors operate, you’re better equipped to make smarter calls on product offerings, pricing, and marketing channels.

Here’s a compelling stat: companies that use documented buyer personas are 71% more likely to surpass their leads and revenue goals. That’s a clear sign that research isn’t just helpful - it’s essential for staying in business.

Think of market research as your strategic compass. It pinpoints friction points in the buyer's journey, highlights underserved markets your competitors might be overlooking, and reveals where your audience spends their time online. Armed with this knowledge, you can allocate your marketing budget to channels that deliver the highest return on investment.

In the fast-moving world of ecommerce, staying static isn’t an option. Consumer preferences evolve, new technologies emerge, and competitors constantly refine their strategies. That’s why market research should never be a one-off project. Make it a habit to conduct quarterly reviews to stay ahead of market changes. As Seller Snap puts it:

Market research is not a one-time endeavor but an ongoing process that enables businesses to adapt to dynamic market conditions.

Start applying these steps now to set your ecommerce business on a path toward sustainable growth. And remember Jay Samit’s wise words:

Data may disappoint, but it never lies.

FAQs

How does using the SMART framework help with ecommerce market research?

The SMART framework is a powerful tool for making ecommerce market research more focused and productive. It ensures your goals are Specific, Measurable, Achievable, Relevant, and Time-bound, helping you stay on track and gather insights that truly matter for your business.

For instance, rather than setting a broad goal like "learn about customer preferences", a SMART goal would look more like this: "Survey 500 customers by December 31 to pinpoint the top three product features they value most." This kind of precision not only keeps your efforts organized but also ensures you're using your resources wisely and making decisions based on solid data.

How do qualitative insights complement quantitative data in market research?

Qualitative insights dig into the why behind the numbers you see in quantitative data. For instance, a survey might reveal that 70% of shoppers prefer free shipping. But it’s through methods like interviews or focus groups that you discover the reasons - maybe it’s about trust in the retailer, worries about hidden fees, or how customers perceive the value of their purchase.

When you blend these qualitative insights with hard data, your findings gain depth. Real customer stories and feedback can highlight unmet needs, common frustrations, or even new trends that raw numbers just can’t capture. This deeper understanding equips you to fine-tune products, sharpen your messaging, and make smarter, more informed decisions.

Why is ongoing market research important for ecommerce businesses?

Keeping up with market research is a must for succeeding in ecommerce. It keeps you in the loop about what your customers want, where the industry is heading, and what your competitors are up to. With this insight, you can spot fresh opportunities, tackle potential challenges, and adjust your strategies to keep up with shifting market demands.

Consistently diving into research ensures your decisions are backed by data and stay on point. This approach helps you stay competitive, grow, and build a solid foundation for long-term success in the fast-paced world of ecommerce.