Competitive Intelligence for Regional Growth

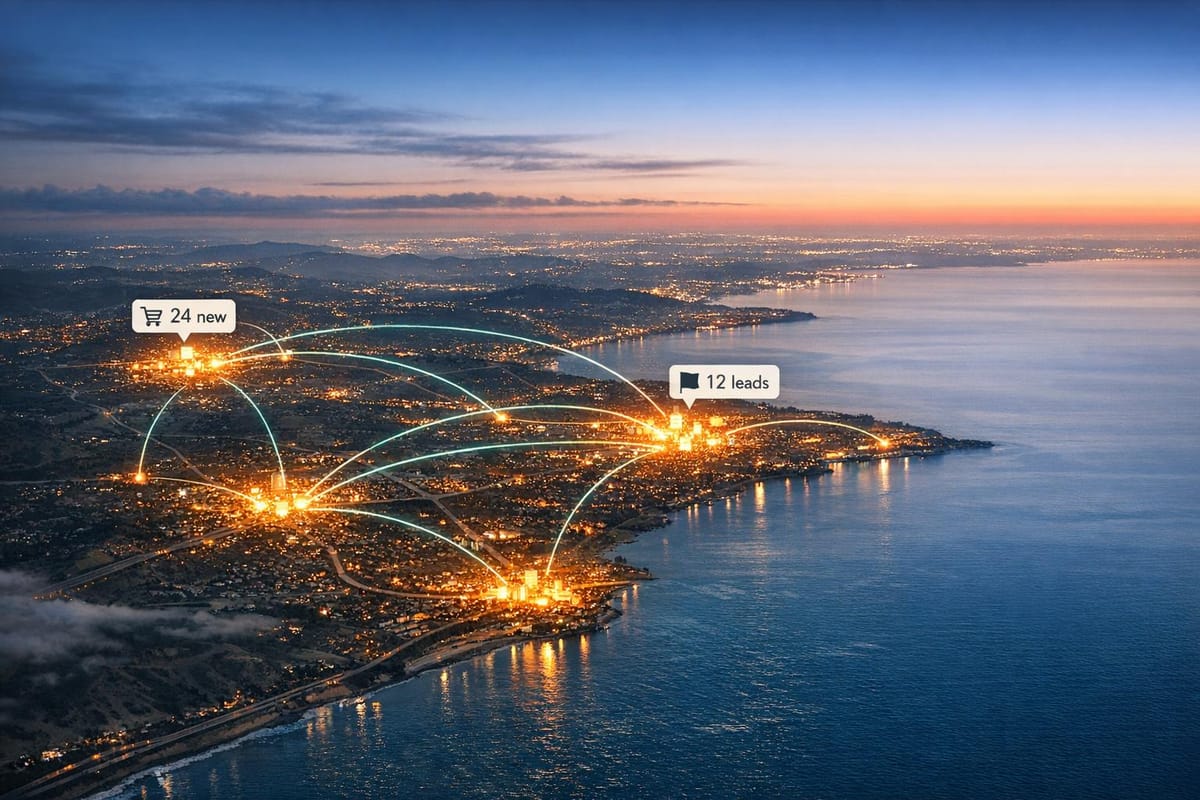

Use real-time competitive intelligence to track regional ecommerce activity, automate lead collection, and make faster, data-driven market decisions.

Competitive intelligence is the practice of analyzing competitors to make smarter business decisions. It’s especially useful for tailoring strategies to specific regions, where customer behavior and market dynamics can vary significantly. Real-time tools like StoreCensus simplify this process by delivering up-to-date data on over 2 million ecommerce stores, helping businesses track competitors, automate lead collection, and act quickly on market changes.

Key Takeaways:

- Regional focus matters: Strategies that work in one area may fail in another due to differences in income, demographics, and shopping habits.

- Manual research is outdated: Traditional methods are slow, error-prone, and often provide incomplete data.

- Real-time insights are critical: Competitors change prices, apps, and strategies frequently, making timely data essential.

- StoreCensus advantage: Tracks 25+ data points per store, offers weekly updates with 99.2% accuracy, and integrates with CRMs for automated workflows.

For businesses, the ability to make informed, quick decisions about regional markets can lead to increased sales, reduced errors, and better positioning against competitors.

Common Problems in Understanding Regional Competition

Incomplete Regional Data

Many businesses struggle to get a clear picture of regional competition because they rely on outdated or incomplete information. For instance, old reports that fail to reflect recent updates - like changes in app installations, pricing strategies, or technology upgrades - leave companies guessing about the current market dynamics. This happens because businesses often depend on static data snapshots, which don’t capture the ever-changing competitive environment.

Adding to the problem, businesses frequently use revenue and traffic estimates to measure competitor strength. However, these numbers are far from reliable. Revenue estimates are only about 30–50% accurate since external tools don’t have access to actual order data. Similarly, traffic estimates, often based on panel data, are only 40–60% accurate. When companies base their regional strategies on such shaky data, they risk making costly errors.

Manual Research Takes Too Much Time

Digging into competitor data manually - whether it’s through visiting stores, scraping websites, or analyzing source code - is both time-consuming and resource-intensive. And even after all that effort, the insights gathered are often outdated and riddled with errors. Automated intelligence tools, on the other hand, can cut research time by up to 60%.

Manual research also tends to focus on a narrow set of competitors, leaving businesses with an incomplete picture of the regional market. By the time the data is collected and analyzed, it’s often already obsolete, making it difficult to act effectively.

Tracking Changes in Real Time is Hard

Regional markets are constantly evolving. Competitors tweak prices daily, roll out new apps to improve conversions, and upgrade their technology stacks to stay ahead. Without real-time tracking, businesses often find themselves reacting too late to these shifts. Manual audits simply can’t keep up with the pace of change across multiple regions.

For example, data from over 100,000 stores shows that the number of apps a store uses is a strong indicator of its success. Stores with six or more apps consistently perform better on lead fit metrics. Without tools that detect these changes as they happen, businesses risk missing key trends and falling behind their competitors.

Localized Competitive Intelligence Webinar by Prasanna Dhungel

How StoreCensus Solves Regional Intelligence Problems

StoreCensus takes the guesswork out of regional competitive intelligence by providing structured, real-time data for over 2 million ecommerce stores. Instead of sifting through outdated reports or spending countless hours researching competitors, businesses gain access to 25+ data points per store, updated weekly with an impressive 99.2% accuracy rate. This robust system allows users to filter stores by location, track changes as they happen, and automate lead collection - offering live insights that address the challenges of regional intelligence head-on.

Filter Stores by Location for Regional Data

StoreCensus makes it easy to narrow down markets by allowing users to filter stores by country and region. Combine location filters with criteria like revenue range, product catalog size, or technology stack to identify high-growth opportunities. For example, you could search for "Fashion retailers in North America with 50+ products and $100K+ monthly revenue" and instantly receive a curated list of potential targets. With a database tracking 2,024,622 stores (as of February 2026) and monitoring over 8,300 apps and 1,000+ technologies, you’re always working with the latest, most accurate data - not outdated snapshots.

Monitor Regional Store Activity in Real Time

StoreCensus also keeps tabs on store activity, sending real-time alerts when important changes occur. For instance, on February 19, 2026, techstore.com added a Klaviyo integration; on February 18, 2026, fashionbrand.com updated its revenue band; and on February 16, 2026, petstore.com switched its theme. These timely updates can signal when competitors are ramping up investments or when prospects might be ready for your solution.

The platform’s "Evergreen Automations" feature further enhances this by acting as a 24/7 sales assistant. It triggers workflows - such as sending personalized emails or routing leads to your CRM - when specific conditions are met. These automated triggers have been shown to deliver 3x higher conversion rates compared to traditional cold outreach.

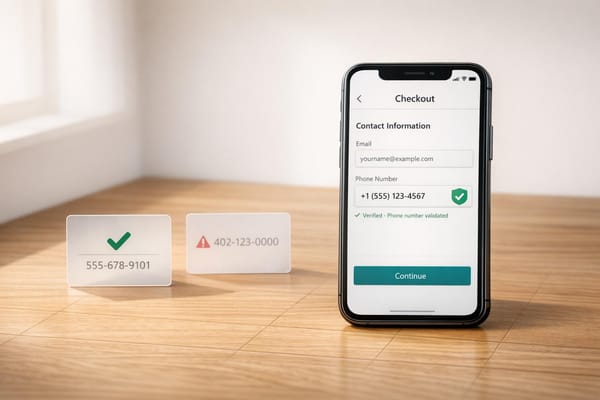

Automate Regional Lead Data Collection

StoreCensus simplifies lead data collection by integrating seamlessly with CRMs like HubSpot and Salesforce, as well as over 5,000 apps via tools like Zapier, Apollo.io, Instantly.ai, and Smartlead.ai. This integration automates the process of enriching regional leads with 25+ verified data points, including contact details, tech stack information, and revenue estimates. By automating these workflows, businesses save an estimated 60% of the time typically spent on manual lead research.

Instead of exporting and updating lists manually, StoreCensus allows you to set filters once and let the platform handle the heavy lifting. For instance, it can monitor when stores uninstall a competitor's app and instantly trigger actions like offering migration assistance or a free trial. This level of automation ensures you stay ahead in competitive markets without the extra workload.

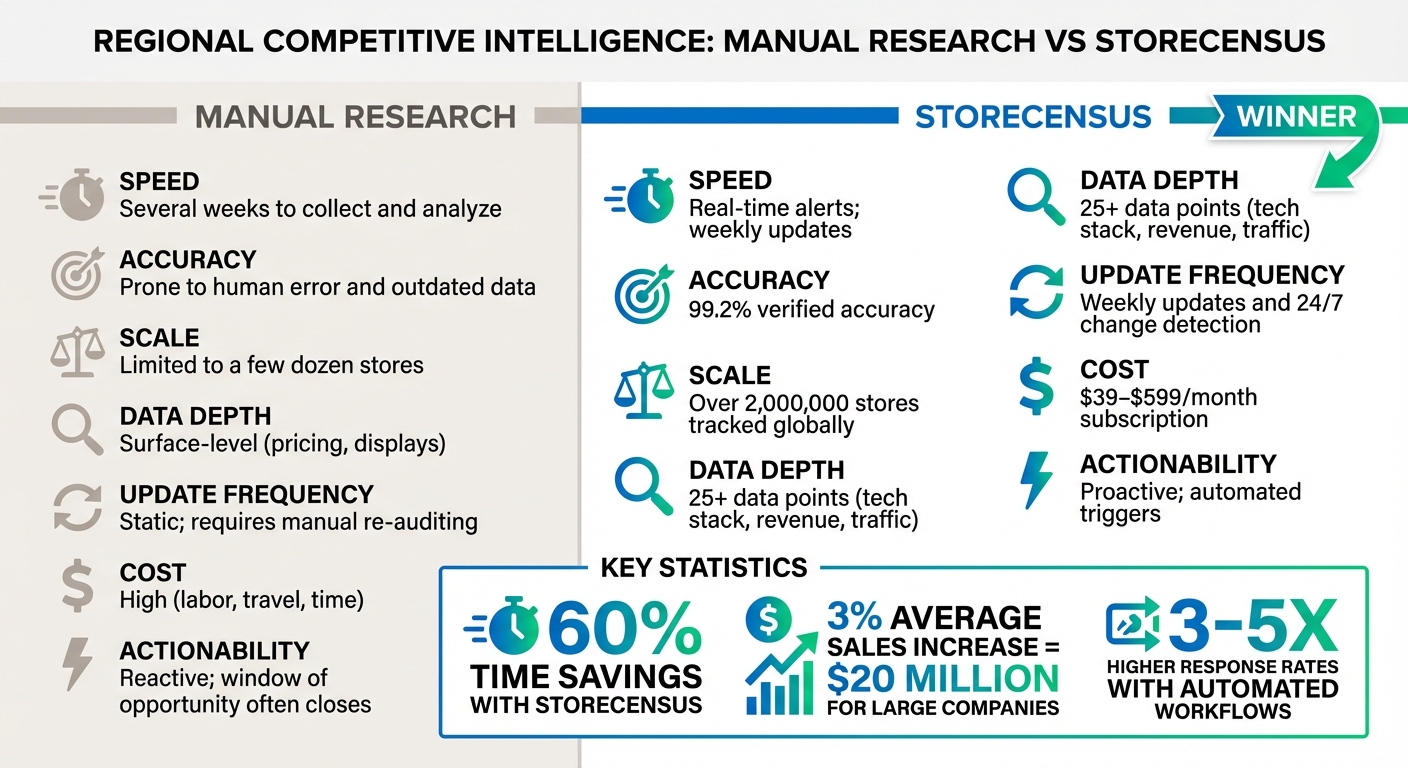

Manual Research vs. StoreCensus for Regional Intelligence

Manual Research vs StoreCensus: Speed, Accuracy and Cost Comparison

When it comes to gathering regional insights, the choice between manual research and automated tools boils down to three key factors: speed, accuracy, and scale. Traditional manual methods - like visiting stores in person, jotting down notes, and inputting data into spreadsheets - are not only time-consuming but also prone to delays. By the time you’ve compiled and analyzed the information, it’s often outdated. As the GoSpotCheck White Paper highlights:

"The copious amounts of manual work required to get information about competitors is so tedious that by the time it's complete the window of opportunity has closed."

Enter StoreCensus. Instead of waiting weeks for results, this tool offers real-time alerts and weekly updates across a network of over 2,000,000 stores. While manual research typically focuses on surface-level information like pricing and displays, StoreCensus dives deeper, capturing backend metrics such as technology usage and revenue trends with an impressive 99.2% verified accuracy.

The financial difference is also striking. Manual research requires significant manpower and incurs hefty travel and time expenses. StoreCensus, on the other hand, operates on a subscription model starting at just $39 per month. Users have reported saving 60% of the time they would usually spend on lead research. Plus, for large companies, even a modest 3% increase in sales from improved competitive intelligence can translate to an extra $20 million in revenue.

Another major advantage of StoreCensus is its ability to provide continuous monitoring. Unlike manual methods that require repeated efforts to update data, StoreCensus automatically detects changes and triggers workflows in real time.

Comparison Table: Manual Research vs. StoreCensus

| Metric | Manual Research | StoreCensus |

|---|---|---|

| Speed | Several weeks to collect and analyze | Real-time alerts; weekly updates |

| Accuracy | Prone to human error and outdated data | 99.2% verified accuracy |

| Scale | Limited to a few dozen stores | Over 2,000,000 stores tracked globally |

| Data Depth | Surface-level (pricing, displays) | 25+ data points (tech stack, revenue, traffic) |

| Update Frequency | Static; requires manual re-auditing | Weekly updates and 24/7 change detection |

| Cost | High (labor, travel, time) | $39–$599/month subscription |

| Actionability | Reactive; window of opportunity often closes | Proactive; automated triggers |

StoreCensus doesn’t just replace manual research - it transforms it. By automating the process, you get faster, more accurate, and actionable insights, all while cutting costs and saving time.

Conclusion: Using Regional Intelligence to Compete Better

Regional growth hinges on having accurate, real-time insights into what competitors are doing in specific markets. The problem? Manual research is slow - taking weeks to compile - and by the time it's analyzed, the market has often shifted. As GoSpotCheck explains:

"In order to maximize opportunities for action, retailers need access to automated, structured, competitive intelligence in real time".

StoreCensus eliminates these delays, allowing you to filter through over 2 million stores by location, technology, and growth signals in just minutes. Whether you're targeting fashion retailers in the Northeast or home goods stores in the Southwest, StoreCensus pinpoints which businesses are expanding, which apps they lack, and when they make changes signaling buying intent. This directly tackles issues like incomplete data and the slow pace of manual research.

The benefits are clear: businesses using competitive intelligence see an average sales increase of 3%, which translates to $20 million for large companies. For smaller teams, the time savings alone are game-changing - StoreCensus users report cutting 60% of the time spent on lead research.

Automation changes the game in regional competition. Set up triggers to notify your team the moment a competitor enters a new market or when a store in your target region uninstalls a competing app. Acting on these real-time signals ensures your outreach is timely and highly relevant. Automated workflows deliver 3–5x higher response rates by engaging prospects at the perfect moment. Plus, you can seamlessly send qualified leads to your CRM or outreach tools, all without manual data entry.

With the competitive intelligence market predicted to hit $100 billion by the early 2030s, businesses that embrace automated regional intelligence today will have a clear edge over those stuck using outdated spreadsheets and guesswork. Starting at just $39 per month, StoreCensus makes cutting-edge regional intelligence accessible to teams of all sizes. Leveraging real-time, automated insights is the key to thriving in an increasingly competitive landscape.

FAQs

What regional signals matter most when sizing up competitors?

Regional signals offer valuable insights into the competitive landscape by focusing on location-specific data. For instance, location data reveals where competitors are physically present and the extent of their market reach. Meanwhile, real-time activity signals - like store openings, closures, or design updates - help track immediate changes in the market.

To dive deeper, analyzing customer behavior trends such as foot traffic patterns and shifts in market share can paint a clearer picture of consumer preferences in specific areas. Adding social engagement metrics from these regions further enriches the analysis, showing how customers interact with brands online.

When this information is combined with data on competitors' store operations and their technology stack, it creates a comprehensive view. This approach helps identify regional opportunities while also highlighting potential threats in the market.

How can I validate competitor revenue and traffic estimates by region?

To check competitor revenue and traffic estimates by region, consider using ecommerce intelligence tools that offer real-time store data. These tools let you filter stores by location and evaluate activity signals such as traffic fluctuations, sales trends, or revenue projections. For instance, platforms like StoreCensus provide precise regional filtering and in-depth data insights, helping you consistently and accurately assess regional performance without depending on outdated reports.

Which real-time store changes should trigger outreach or strategy updates?

Outreach efforts or strategy adjustments should respond to real-time changes like app installations or removals, design updates, shifts in business activity, or notable changes in store technology or customer traffic. These moments often signal growth, new launches, or operational adjustments, offering valuable opportunities for more focused and effective engagement.