CMS Adoption Trends by Ecommerce Platform 2026

2026 ecommerce CMS analysis: market share shifts, Shopify vs WooCommerce, headless and composable growth, and AI integrations shaping platform choice.

Choosing the right CMS is more important than ever in 2026. With over half of online sales happening on mobile, your platform directly impacts visibility and conversions. The global ecommerce CMS market, valued at $1,012M in 2024, is growing fast, expected to double by 2031. Here’s a snapshot of the current landscape:

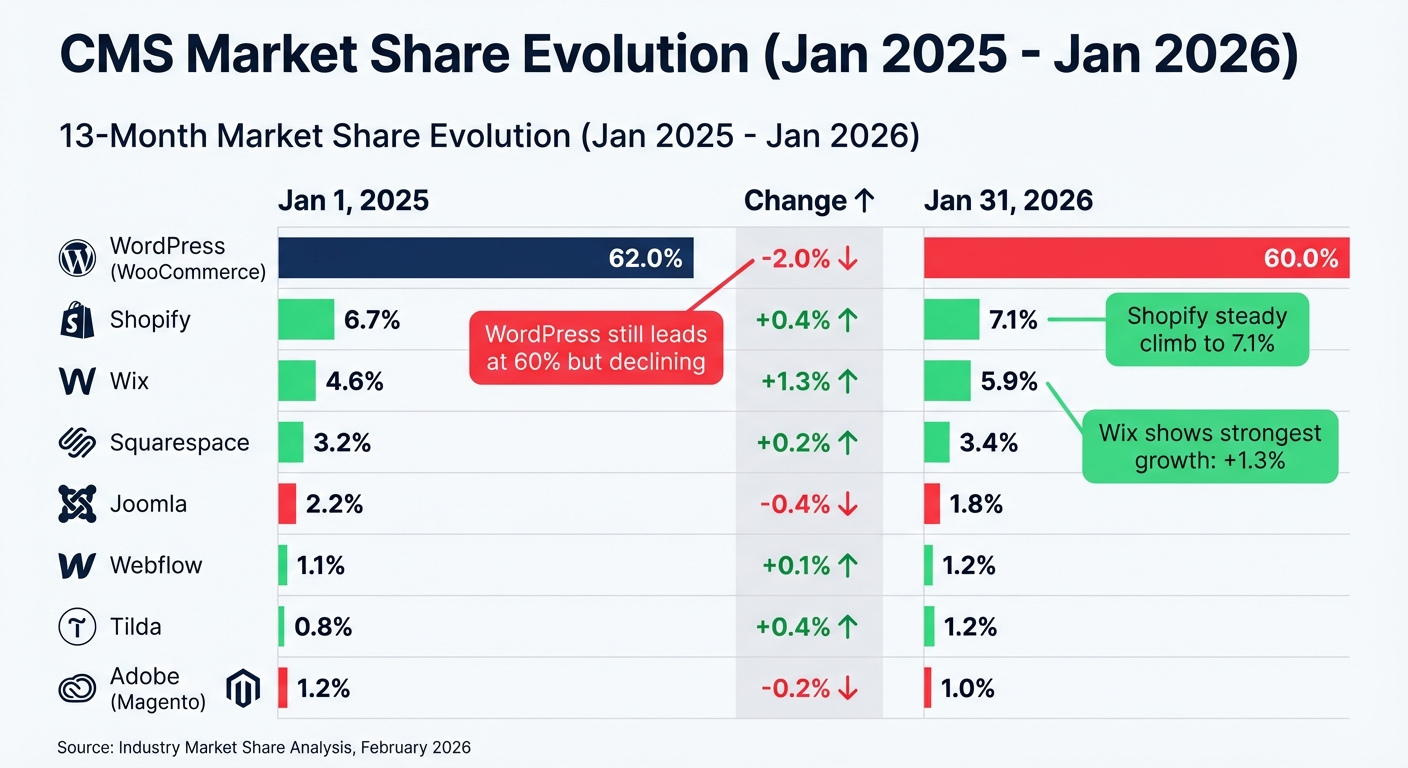

- WordPress (WooCommerce) leads with 60% market share but is seeing a slight decline (-2% YoY).

- Shopify is growing steadily, now at 7.1% market share, powering 2.8M stores with strong U.S. dominance (30% share).

- Wix has jumped to 5.9%, appealing to small businesses and solo entrepreneurs.

- Headless CMS and composable commerce are gaining traction, especially among enterprises, offering flexibility and scalability for omnichannel strategies.

- AI tools and automation are transforming ecommerce operations, with platforms integrating advanced features like product recommendations and workflow automation.

Key Takeaways:

- Small businesses favor WooCommerce for affordability and flexibility, while Shopify thrives with its all-in-one approach.

- Platforms like Tilda and Webflow are gaining users by offering design flexibility for visually rich storefronts.

- Enterprises are moving toward headless and composable setups to handle complex needs.

The CMS you choose should align with your business size, technical expertise, and growth goals. Hosted platforms like Shopify simplify management, while open-source solutions like WooCommerce offer more control. For enterprises, headless setups are becoming the standard for scaling across channels.

CMS Market Share in 2026

CMS Market Share Changes 2025-2026: WordPress, Shopify, Wix Growth Comparison

As of early 2026, the CMS landscape continues to be dominated by WordPress, though its grip is slightly loosening. WordPress now powers 60.0% of all websites using a CMS, down from 62.0% just over a year ago. This small decline suggests that some users are gravitating toward platforms that offer tailored ecommerce features or simpler management options. Here's a closer look at how the market is shifting.

Top CMS Platforms by Market Share

The market share data highlights a mix of stability and movement. Shopify has grown from 6.7% to 7.1%, and Wix has jumped from 4.6% to 5.9%. Meanwhile, older platforms like Joomla and Adobe Commerce (Magento) have seen declines, with Joomla dropping from 2.2% to 1.8% and Adobe Commerce slipping from 1.2% to 1.0%.

| CMS Platform | Market Share (Jan 1, 2025) | Market Share (Jan 31, 2026) | Change |

|---|---|---|---|

| WordPress (WooCommerce) | 62.0% | 60.0% | -2.0% |

| Shopify | 6.7% | 7.1% | +0.4% |

| Wix | 4.6% | 5.9% | +1.3% |

| Squarespace | 3.2% | 3.4% | +0.2% |

| Joomla | 2.2% | 1.8% | -0.4% |

| Webflow | 1.1% | 1.2% | +0.1% |

| Tilda | 0.8% | 1.2% | +0.4% |

| Adobe (Magento) | 1.2% | 1.0% | -0.2% |

While WordPress still leads by a wide margin, Shopify and Wix are steadily climbing, appealing to users with specific needs. Shopify, for instance, focuses heavily on retail, as evidenced by its 2,822,495 live stores, compared to WooCommerce's broader reach of 4,453,097 stores. These numbers highlight the contrast between WordPress's content-first approach and Shopify's retail-driven model.

At the same time, newer platforms are starting to make waves.

Rising CMS Platforms

Square Online has emerged as the fastest-growing platform in 2026, now powering 288,213 stores. Its appeal lies in catering to micro-merchants - small businesses and solo entrepreneurs looking for straightforward, no-fuss storefronts.

Tilda and Webflow are also gaining traction, with Tilda increasing its market share from 0.8% to 1.2%. These platforms are popular among users who prioritize design flexibility and no-code tools, making them ideal for visually sophisticated storefronts without the need for extensive technical knowledge.

Shopify's Market Position in 2026

Shopify Market Share and Growth Data

Shopify holds a commanding position in the global ecommerce platform market, with a 26% share worldwide and an even stronger 30% share in the U.S., making it a leader in the hosted CMS space. By Q1 2026, Shopify supported 2,846,464 live stores and achieved an 18% year-over-year growth in Q4 2025. These numbers highlight Shopify's steady climb as the ecommerce market matures.

In 2023, Shopify processed $236 billion in gross merchandise volume (GMV) - a 20% increase compared to the previous year. It also accounts for 11% of all U.S. retail ecommerce sales, second only to Amazon. While there was a slight 0.5% dip in Q1 2026 due to market consolidation, Shopify maintains a strong 2:1 migration ratio. The platform's churn rate remains low at 2.2%, and for every dollar Shopify earns, merchants generate $40.82 in revenue. These figures underscore Shopify's robust market presence and set the foundation for understanding its growth-driving features.

Features Driving Shopify Adoption

Shopify's growth is fueled by features designed to improve conversion rates and streamline operations, aligning with broader trends like AI integration and unified commerce. Shopify's conversion rates consistently outperform competitors by an average of 15%, reaching as high as 36% in certain configurations. Desktop checkout completion rates stand at an impressive 47.5%, while Shop Pay adoption contributed to a 60% year-over-year increase in Black Friday Cyber Monday sales. Notably, 79% of all Shopify traffic now comes from mobile devices.

The Shopify App Store, with over 13,000 apps, plays a key role in driving innovation. A significant 87% of merchants use third-party solutions for features like reviews, email marketing, and loyalty programs. On average, stores run 6.4 apps, with product reviews and cart customization leading in popularity - boasting over 1.3 million and 945,000 installations, respectively.

Shopify Markets is another standout feature, enabling merchants to expand globally from a single dashboard. It simplifies managing localized storefronts, duties, and taxes across more than 17 countries. The platform’s unified Point-of-Sale (POS) system ensures seamless synchronization of online and offline inventory, payments, and customer data. AI-powered tools like Shopify Magic and Sidekick further enhance efficiency by automating tasks such as store design, landing page creation, and product listings.

Real-world success stories highlight the impact of these features. For example, Allied Medical transitioned from a customized open-source CMS to Shopify, resulting in a 40% reduction in back-end task time, a 14% increase in transaction volume, and a 4.7% rise in online revenue after unifying inventory across three warehouses. Katie Noble, Managing Director at Allied Medical, shared:

"We've moved from a platform that held us back to one that empowers us to scale, automate, and provide a better experience for our customers."

Similarly, Filtrous switched from BigCommerce and launched a comprehensive B2B buying experience in just 63 days, achieving a 27% boost in organic conversion rates. Luxury home décor brand Lulu and Georgia also benefited from migrating their 40,000 SKU catalog to Shopify, eliminating site crashes and managing surges in demand more effectively.

Open-Source CMS Adoption: WooCommerce and Alternatives

WooCommerce Market Position

As of January 2026, WooCommerce powers 4,453,097 live stores, claiming a 37% share of ecommerce platforms. Built on WordPress, which commands a 60% share of the CMS market, WooCommerce benefits from WordPress's strong reputation and SEO-friendly structure. Its free plugin model is especially appealing to businesses focused on content-first strategies, as it avoids licensing fees and recurring subscription costs. This makes it a go-to solution for cost-conscious merchants, although it does require technical know-how to manage hosting, security, and potential plugin conflicts.

While WooCommerce's low upfront costs are attractive, maintaining security and keeping everything updated can become a headache, possibly leading to technical debt over time. That said, its widespread adoption underscores its value, particularly for businesses that prioritize flexibility and are willing to trade convenience for control. This balance between cost savings and technical responsibility often frames the broader discussion of open-source versus hosted CMS platforms.

Open-Source vs. Hosted CMS Comparison

WooCommerce's strengths and limitations reflect the larger conversation around open-source and hosted CMS platforms. At its core, the decision comes down to control versus convenience. Open-source platforms like WooCommerce and Drupal Commerce (used by 10,509 active stores) provide full customization and direct code access, while hosted solutions such as Shopify and Wix simplify maintenance and security but limit customization options.

| Feature | Open-Source (WooCommerce / Drupal) | Hosted SaaS (Shopify / Wix) |

|---|---|---|

| Upfront Cost | Lower; software is often free to install | Higher; requires monthly subscription fees |

| Customization | High; full access to code and database | Limited to platform ecosystem and APIs |

| Technical Requirements | High; merchants handle hosting, security, and updates | Low; managed by the provider |

| Market Position | Leads in total store count (WooCommerce) | Leads in revenue processed and US market share (Shopify) |

| Maintenance | Requires manual oversight or external support | Fully automated by the provider |

Regional preferences also play a role in platform selection. Open-source platforms are particularly popular in Europe, where GDPR and data protection laws drive businesses to maintain direct control over their data. On the other hand, hosted platforms dominate when measured by metrics like revenue processed or Gross Merchandise Volume (GMV).

For businesses with strong technical expertise, open-source solutions offer unparalleled customization and help avoid the pitfalls of "platform lock-in." Meanwhile, content-focused merchants can leverage WooCommerce for its integration with WordPress, taking advantage of its superior SEO and content management features.

Headless CMS and Composable Commerce Growth

Benefits of Headless CMS Architecture

Headless CMS architectures are now a go-to choice for 64% of enterprise organizations, offering measurable improvements in both performance and operational flexibility. By separating the frontend from the backend, businesses can use the "Create Once, Publish Everywhere" approach to deliver content across websites, mobile apps, voice assistants, and even IoT devices - all from a single hub.

This setup enables organizations to speed up their development cycles, with reported 30-50% faster time-to-market for new features. Plus, omnichannel shoppers - those who interact with businesses across multiple platforms - tend to spend 15-30% more than single-channel customers. On the technical side, lightweight frameworks like React and Next.js enhance page speed and Core Web Vitals scores, which are crucial for user experience and SEO. Additionally, the separation of frontend and backend reduces potential vulnerabilities, bolstering security.

"Headless architecture is increasingly adopted by growing ecommerce brands; 64% of enterprise organizations are currently using a headless approach, with users reporting improved scalability and competitive advantage." - Mandy Spivey, BigCommerce

The global headless commerce market is on a steep growth trajectory, expected to expand from $1.7 billion in 2025 to over $7 billion by 2032. For large-scale ecommerce operations, the financial payoff is quick, with a typical payback period of 3 to 5 months. Pricing for headless platforms varies significantly, with options like Directus starting at $20,000 annually and Contentful exceeding $120,000, depending on the features and scale needed.

These benefits have prompted many enterprises to pair headless CMS with a composable commerce approach to further optimize their ecommerce ecosystems.

Composable Commerce Adoption Patterns

Composable commerce, often paired with headless architecture, is becoming the standard for businesses generating over $5 million in annual GMV. This model allows companies to build custom ecommerce stacks using APIs. For instance, they might use Shopify for checkout, Contentful for content management, and Yotpo for customer retention.

A standout example is UK retailer SportsShoes, which transitioned from a legacy system to a composable setup using BigCommerce's API infrastructure in January 2026. This shift, led by CTO Jon Cleaver, enabled the launch of the company’s first mobile app. The results? Checkout conversion rates doubled compared to their old system.

"We've launched an app which has been incredibly successful. We would not have been able to do that with our old legacy website. It wasn't API driven, it wasn't composable, but BigCommerce has allowed us to open that door and open up those new channels. Our checkout conversion is broadly double what it used to be before." - Jon Cleaver, Chief Technology Officer, SportsShoes

This trend isn’t limited to retail. B2B and heavy industries are also embracing composable architectures to manage complex tasks like procurement workflows, real-time pricing, and ERP integrations. As the global B2B ecommerce market approaches $36 trillion, these solutions are becoming essential. Meanwhile, DTC brands are leveraging composable setups to ensure seamless experiences across platforms like social commerce, AI-driven search engines, and traditional web storefronts.

Composable systems also prepare businesses for emerging technologies. Among companies using headless architecture, 79% rate their scalability as "strong", positioning them to adapt to advancements like AR/VR and spatial computing.

CMS Preferences by Business Type

Business type often shapes CMS platform choices, aligning with broader market trends and specific operational needs.

CMS Platform Preferences by Segment

Small businesses tend to choose platforms that prioritize ease of use and affordability. WooCommerce stands out for its cost efficiency and the flexibility offered by the WordPress ecosystem. Shopify, on the other hand, appeals to those looking for an all-in-one solution that takes care of hosting, security, and maintenance.

For solo entrepreneurs and micro-businesses, design-focused and managed solutions like Wix and Squarespace are particularly attractive. Wix powers about 14% of ecommerce sites, while Squarespace accounts for 9%. Shelley Walsh, Managing Editor at Search Engine Journal, notes:

"The growth of website builders, such as Wix and Squarespace, indicates that small businesses want a more straightforward managed solution, and they have started to nibble on market share from the bottom".

Enterprise operations have different priorities. Large-scale B2B companies often choose platforms like Magento (Adobe Commerce) for their ability to handle complex workflows. Salesforce Commerce Cloud, though powering only 5,194 stores, serves major global brands like Patagonia and PUMA. Many enterprises are also adopting headless architectures to gain flexibility in front-end design and optimize performance.

Direct-to-consumer (DTC) brands focus on platforms that enable quick market entry and high conversion rates. Shopify has become a go-to for these brands, accounting for 11% of all U.S. retail ecommerce sales projected by 2026. These businesses often rely on extensive tech stacks, with about 12% of Shopify stores running 10 or more third-party apps to manage tasks like inventory, fulfillment, and marketing, according to StoreCensus data tracking over 2.5 million active stores.

These preferences highlight how cost, integration, and conversion strategies vary across business types.

Factors Influencing Platform Selection

The choice of platform often reflects specific operational needs. For small businesses, budget constraints play a major role. WooCommerce, for example, has no licensing fees, but users must cover hosting, security, and developer support to manage plugin conflicts and apply security patches. Shopify’s subscription model, with predictable costs and minimal technical upkeep, appeals to those willing to pay for convenience.

For enterprises, integration capabilities are crucial. These organizations require platforms that seamlessly connect with ERP systems, supply chain tools, and multi-stakeholder workflows. With the global B2B ecommerce market expected to hit $36 trillion by 2026, platforms must handle far more than just storefront design.

In the DTC space, conversion efficiency has become a key metric as customer acquisition costs rise. Platforms are chosen for their checkout performance and ability to incorporate AI-powered tools. For instance, bargain retailer UntilGone introduced AI-driven product recommendations in their transactional emails in late 2023, reporting a 200% revenue increase by year’s end.

Across all segments, the trend toward hosted SaaS solutions is growing. The number of websites operating without a CMS dropped by 2.8 percentage points between 2024 and late 2025, indicating even smaller sites are adopting structured platforms. Shelley Walsh highlights this shift:

"Wix is positioning itself beyond a lightweight website builder that consistently invests in branding and platform capabilities, making it a viable contender for mid-market adoption".

CMS Integration with Automation and AI

Modern CMS platforms are embracing AI and automation to streamline operations and enhance functionality. The numbers tell the story: as of February 1, 2026, the average Shopify store uses 6.4 apps to manage tasks like inventory and customer service. Meanwhile, 12% of merchants operate more complex setups, using 10 or more apps to handle intricate workflows. This dynamic ecosystem allows businesses to leverage automation while keeping core CMS features streamlined and adaptable.

Interestingly, about 2.8% of all app installations - more than 454,000 changes - occur monthly as merchants refine their tech stacks. This constant adjustment highlights the growing interest in AI-powered tools to improve efficiency. On the other hand, 18% of merchants stick to native, no-code CMS features, showing that platforms are increasingly automating essential tasks without requiring third-party apps. This creates a solid foundation for advanced AI tools that enhance backend operations and drive revenue.

AI-Powered Features in Modern CMS

AI is no longer just about chatbots - it’s reshaping backend operations in ways that directly boost revenue. For example, UntilGone used AI to personalize product recommendations in transactional emails, resulting in a 200% increase in revenue. AI-driven recommendation engines are now so effective they can account for up to 35% of ecommerce revenue.

AI is also revolutionizing catalog management. Platforms like Feedonomics use machine learning to standardize product details, correct inconsistencies, and create structured data, improving product visibility across sales channels. This is crucial as 86% of consumers want AI assistance for product research, and 80% depend on AI-generated answers for about 40% of their searches.

When it comes to automation tools, certain categories stand out. Product review tools lead the pack with 1,369,465 active installations (8.4% market share), followed by cart customization tools with 945,163 installations. These tools help merchants build trust and optimize the checkout process without manual input. Email marketing automation, driven by platforms like Klaviyo, has also gained momentum, with 915,920 installations, as businesses shift their focus to owned marketing channels to improve ROI and reduce reliance on paid ads.

No-Code and Low-Code CMS Tools

AI is transforming backend processes, but no-code and low-code tools are empowering teams without technical expertise to manage workflows effectively. For instance, Makeswift allows marketing teams to create landing pages and update templates without needing developer resources. This trend is gaining traction as 23% of organizations now scale AI systems capable of autonomously comparing products and negotiating prices.

Other tools, like GitHub Copilot, Cursor, and Claude, enable teams to write scripts, modify API requests, and handle data transformations using natural language prompts. While these tools don’t eliminate the need for developers, they free up engineering teams to focus on more strategic, high-impact projects.

A compelling example of this shift comes from UK retailer SportsShoes. After adopting a composable architecture using BigCommerce’s API-driven infrastructure, the company launched its first mobile app and doubled its checkout conversion rate. Jon Cleaver, the brand’s CTO, explained:

"We've launched an app which has been incredibly successful. We would not have been able to do that with our old legacy website. It wasn't API driven, it wasn't composable, but BigCommerce has allowed us to open that door... Our checkout conversion is broadly double what it used to be before".

The rise of visual builders is also evident in platforms like WordPress. Tools like the Block Editor (4.94% share) and Elementor (8.83% share) are gaining popularity, enabling non-developers to create and update storefronts with drag-and-drop functionality while maintaining professional design standards.

For businesses looking to stay ahead, platforms like StoreCensus offer valuable insights. By tracking app integrations and automation trends across over 2.5 million ecommerce stores, StoreCensus helps merchants and service providers identify which tools are gaining popularity and which are being phased out. This kind of intelligence is key in an industry where technology stacks are always evolving.

Conclusion

As of 2026, there are 12,989,444 live ecommerce stores spread across 100 platforms. WooCommerce leads in store count with 4,453,097 active stores, while Shopify powers 2,822,495 stores and dominates in revenue and U.S. market share. The "best" platform doesn't exist - what matters is finding the one that aligns with your business model and growth stage.

When choosing a platform, prioritize scalability, ecosystem capabilities, and mobile readiness. With over half of online sales now coming from mobile devices, a seamless mobile experience is no longer optional - it's essential. This foundation ensures you're ready to integrate emerging technologies like AI and headless solutions.

AI-powered personalization has already boosted conversion rates for many ecommerce brands, while headless architectures are simplifying operations. These advancements highlight the need to adapt, especially as 2.8% of app installations shift monthly, reflecting merchants' ongoing efforts to refine their tech stacks.

To make informed decisions, evaluate factors like GMV, regional market reach, and whether you need an all-in-one platform or a composable architecture. For smaller businesses, platforms like Square Online offer quick accessibility and growth potential, while enterprise-level brands often prefer Salesforce Commerce Cloud or Magento for their scalability. Staying ahead in this competitive landscape requires constant access to up-to-date market insights.

StoreCensus provides real-time data on technology adoption across 2.5 million ecommerce stores, helping merchants identify trends and optimize their tech strategies effectively.

FAQs

What are the main advantages of using a headless CMS for ecommerce?

Using a headless CMS for ecommerce offers several advantages that make it a great choice for businesses looking to stay ahead in the digital space. By separating the back-end content management system from the front-end presentation layer, companies can deliver customized and dynamic user experiences across a variety of platforms - whether it’s a website, mobile app, or even a voice assistant. This flexible setup allows developers to create unique interfaces without being tied down by the limitations of traditional systems.

One standout benefit is the ability to achieve better scalability and faster performance. Since the front-end operates independently, it can be fine-tuned for speed and responsiveness, which helps reduce load times and keeps customers engaged. On top of that, headless CMS solutions work seamlessly with tools like CRM systems, payment gateways, and personalization platforms, making it easier for businesses to offer consistent shopping experiences across multiple channels. This approach gives ecommerce brands the agility they need to adapt and thrive in today’s fast-moving digital world.

How does Shopify's market share and growth in 2026 compare to other ecommerce platforms?

In 2026, Shopify solidifies its role as a top ecommerce platform, steadily increasing its market share. While WooCommerce still holds a larger global merchant base, Shopify is gaining traction, especially among small and mid-sized businesses that prioritize ease of use and seamless app integrations.

A big part of Shopify's success comes from its responsiveness to shifting ecommerce trends. By providing tools tailored to the changing needs of businesses, Shopify has become a go-to platform for merchants navigating competitive markets that demand flexibility and growth potential.

Why would a business choose an open-source CMS like WooCommerce instead of a hosted solution?

A business might choose an open-source CMS like WooCommerce because it provides more freedom and control when it comes to customization and managing data. Unlike hosted platforms, open-source solutions let businesses design their online stores to meet specific requirements, without being confined by fixed templates or limited features.

WooCommerce is a popular option, powering approximately 39% of online stores worldwide. This widespread use reflects its reliability and the strong community support behind it. Another key advantage is that it avoids vendor lock-in, granting businesses complete ownership of their data and the flexibility to select hosting providers or integrate third-party tools as needed.